OPS Modules

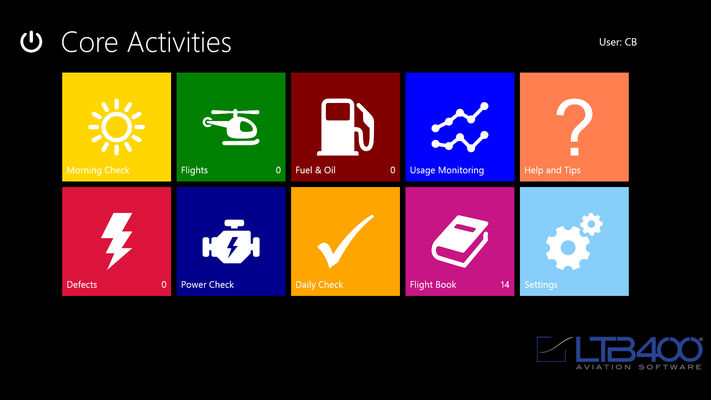

(IFE) Tablet Flight Operation

Operational data entry via windows tablet:

- Flight data recording

- Individual User rights

- Daily check, with transmission of actual data

- Power Check (helicopter)

- Detecting Fuel & Oil

- Findings/Defects

- Technical Log

- Feedback to Flight Planning/CAMO

(FEP) Flight Operation System

Flight operation system module, especially for helicopter operator:

- License types and license monitoring

- Notification system

- Qualification for the flight order

- Own flight orders / types of equipment

- Record resources and services for flight use

- Authorities, departments, mission types

- Employee administration, Crew and resource planning

- Shift plans

- Graphical view of the flight orders

- Flight order, flight operations and findings

- Refueling, landing fees, etc.

- Evaluation options with export to Excel

- Invoicing

- Interface to accounting